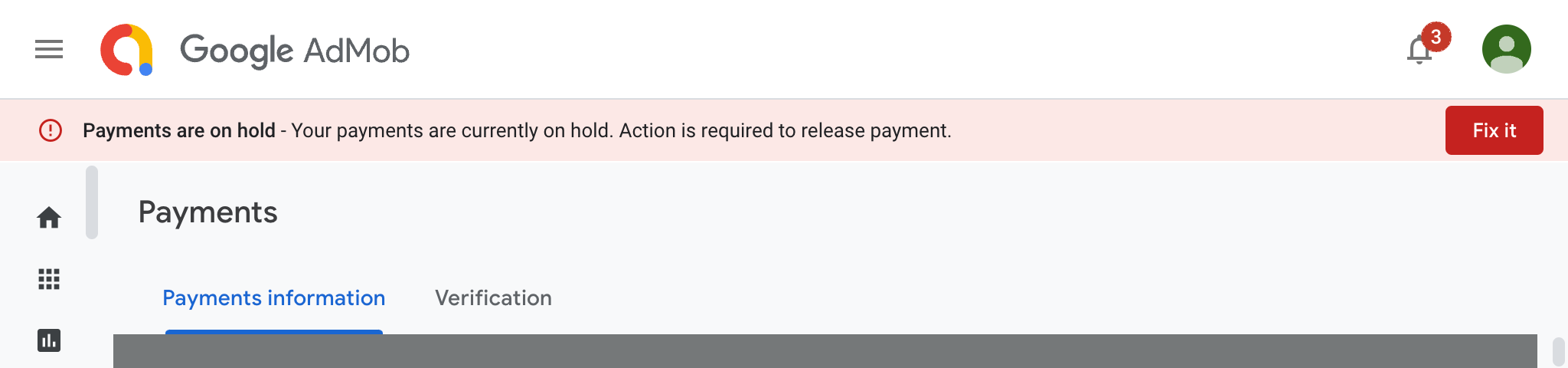

My Google payments for Apps using AdMob were on hold. Thats not good! How do you fix it?

Contents

Tax residency

Google recently adjusted the settings for Payments to include tax declarations for Taiwan and Ireland. This is something that only the administrator of the account can change, so you'll need to find the original administrator details for when the account was set up. Once you have those you can sign in to the Google AdMob console and edit your payments information. Its the Tax info settings that you'll need.

You probably did this when you set up your Google Payments profile, and provided a tax form for the United States. This is something i covered in Managing U.S. tax info with Google. You need to go through the same rigmarole for Ireland, and Taiwan.

Status verification for the United States (for a UK based company)

This is relatively easy and you probably already did it when you set up your Google Payments information. Fill in the online W8-BEN-E form and get verified. Remember that with great power comes great responsibility. You'll have to register with the US tax authorities and comply with their reporting requirements. See my other article : Managing U.S. tax info with Google.

Status verification for Ireland (for a UK based company)

This is easy. Ireland accepts your certificate of incorporation as a company in England or Wales. So just upload it. Google will verify it and you'll see the status change once this has happened. Well done Ireland!

Status verification for Taiwan (for a UK based company)

This is quite a bit more complex. I tried the UK certificate of incorporation but that is not accepted by Taiwan. You will need a tax exemption treatment document from your tax authority. In the UK this is HMRC, and you can find out more at gov.uk - "Get a certificate of residence" which says that companies where the Large Business Service deal with their tax affairs should send CoR requests using the RES1 online service. Screenshots of each screen on the online form are below. Once completed you'll rather ludicrously have to wait for HMRC to process and post you a certificate in the regular mail which you will then have to scan into the Google payments information section to submit. See also : https://www.ntbna.gov.tw/eng#gsc.tab=0

Applying for a certificate of residence from the UK tax authority HMRC

- Sign in to UK Government Gateway

UK Government Gateway sign in - What type of organisation are you applying for? (Limited company, partnership or public body)

What type of organisation are you applying for? - What is your full name?

What is your full name? - What is the name of the limited company?

What is the name of the limited company? - What s the unique tax reference (UTR) for the company?

What s the unique tax reference (UTR) for the company - Is the company newly incorporated?

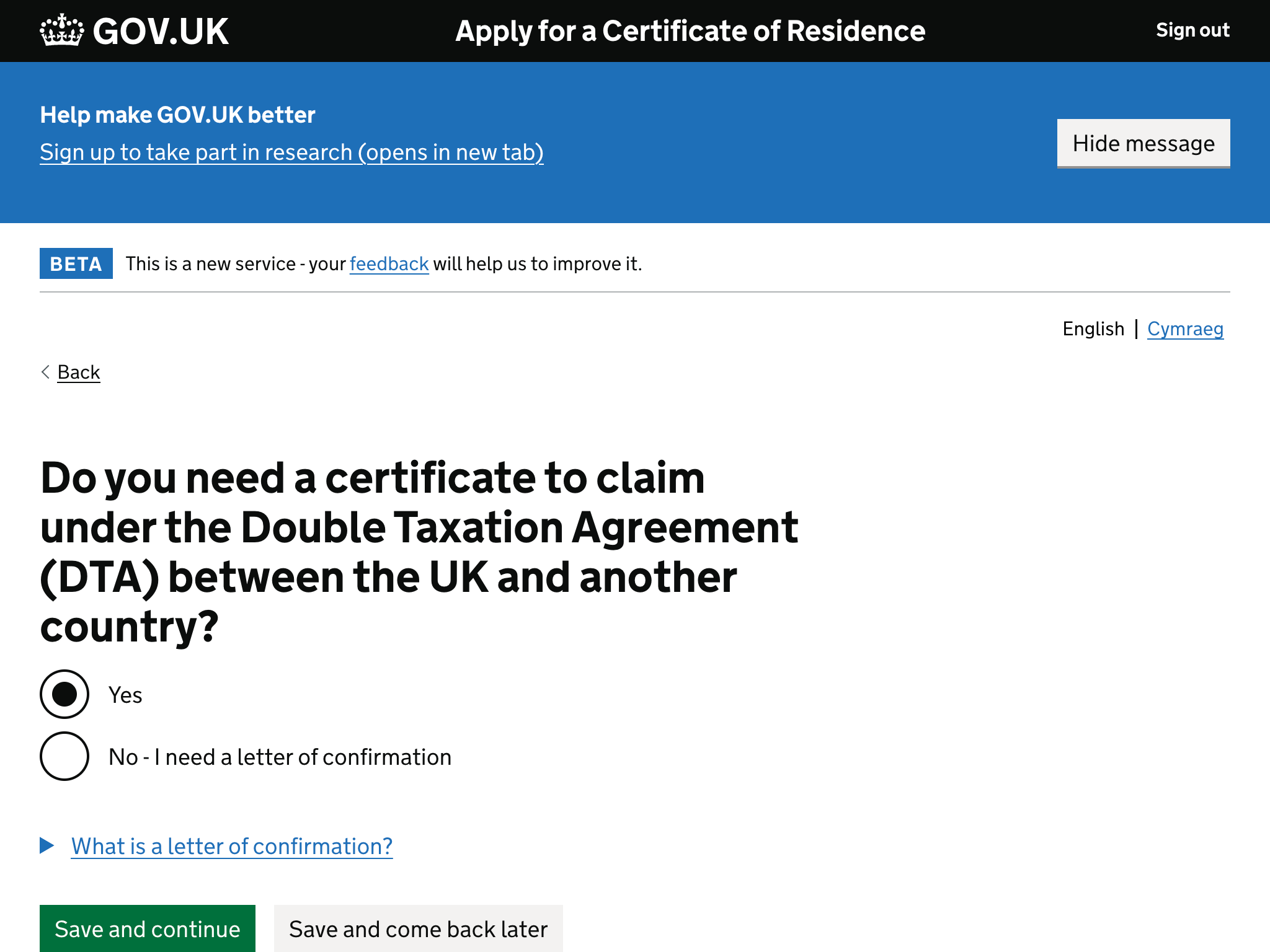

Is the company newly incorporated? - Do you need a certificate to claim under the double taxation agreement (DTA) between the UK and another country?

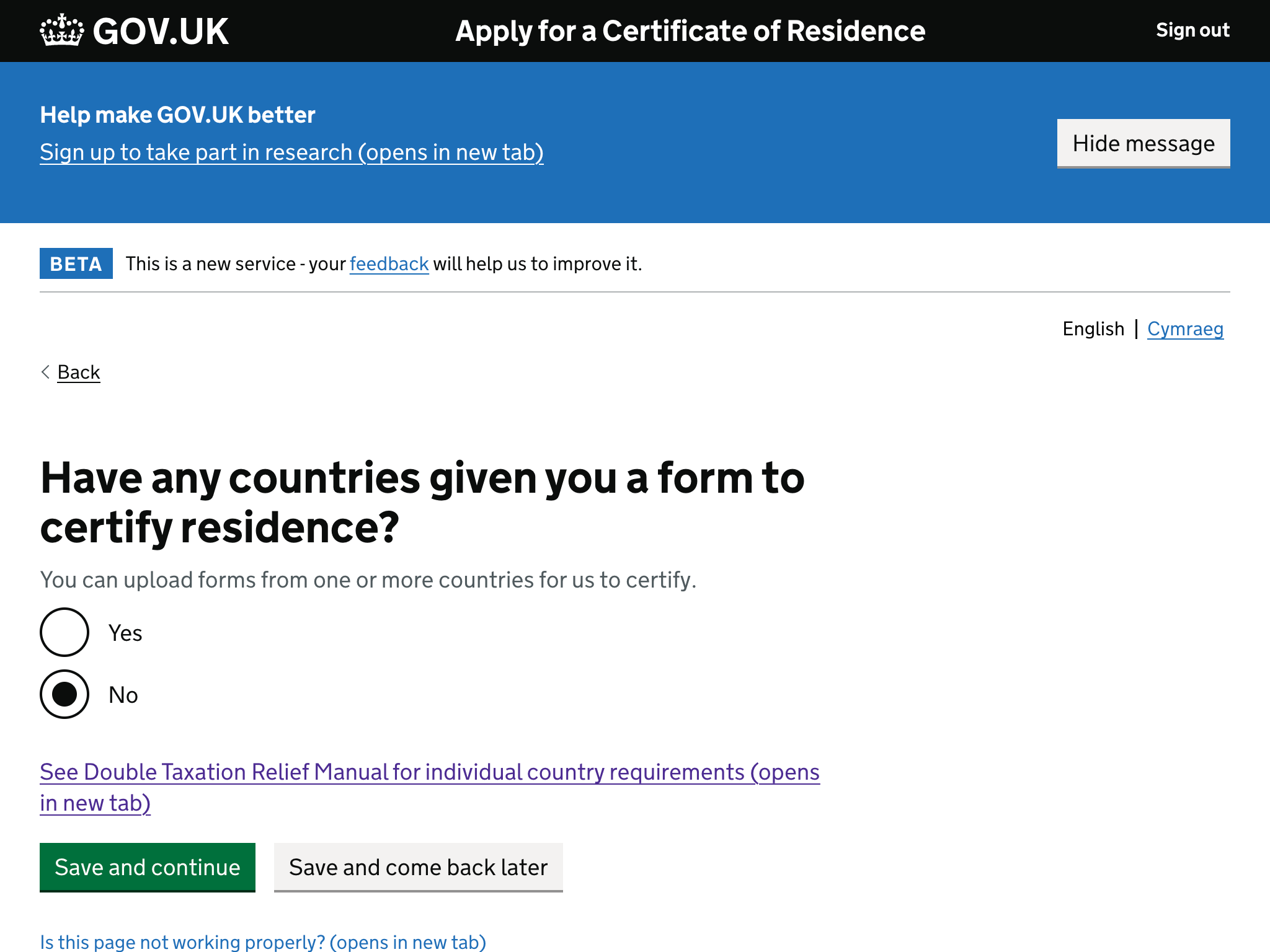

Do you need a certificate to claim under the double taxation agreement (DTA) between the UK and another country? - Have any countries given you a form to certify residence?

Have any countries given you a form to certify residence? - Which country do you want a certificate for?

Which country do you want a certificate for? - What type of income will your company generate in Taiwan?

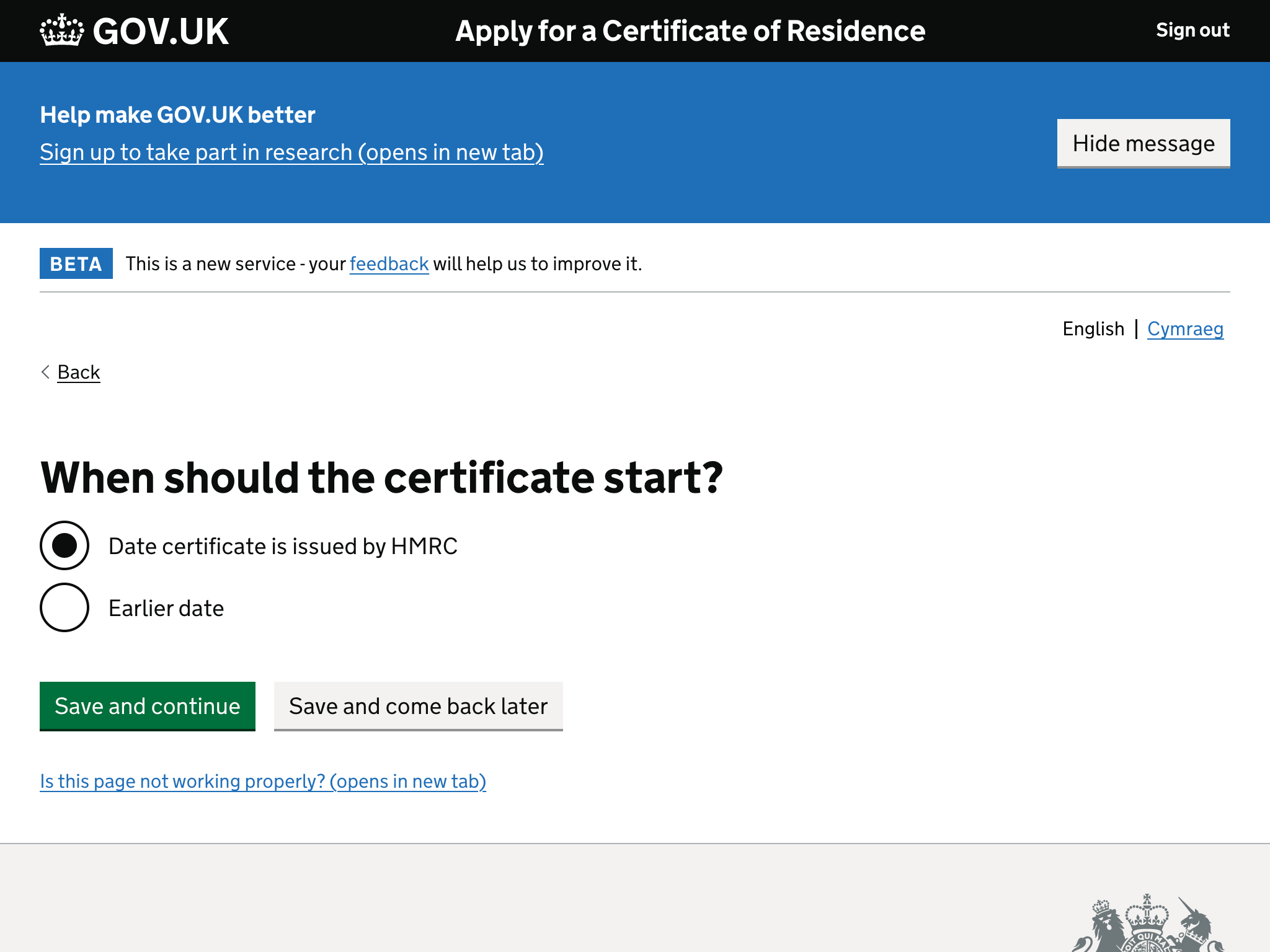

What type of income will your company generate in Taiwan? - When should the certificate start?

When should the certificate start? - How many copies of the certificate do you want?

How many copies of the certificate do you want? - Where do you want the certificate sent?

Where do you want the certificate sent? - What us your email address?

What us your email address? - Can we contact you by telephone?

Can we contact you by telephone? - View the summary (not shown because it has company informaiton on it) and Click 'Agree and submit'

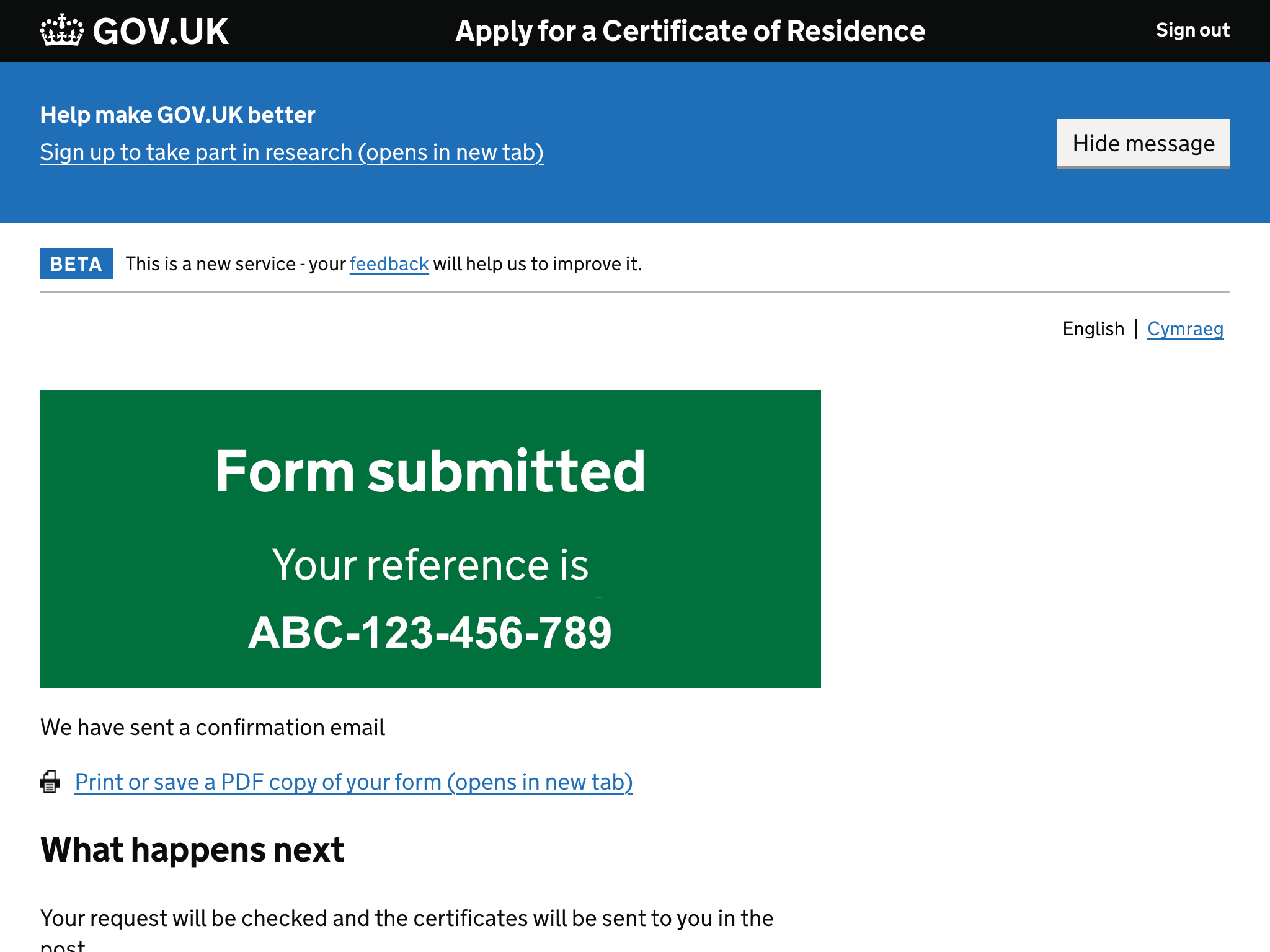

- Note down the reference and look for a confirmation in email.

Note down the reference